When shopping for automobile financing, pay close attention to interest rates. These rates play a significant role in your repayments and the total cost of the loan. If you find yourself scratching your head looking at car financing options, you’re not alone.

Plenty of car buyers, especially beginners, don’t know where to start when it comes to finding the right car finance. In this quick guide, we explain what you need to know about car loan interest rates and how to get the best deal possible.

Learn the basics of car loan interest rates

First let’s answer the age-old question: ‘How do car loans work?’ It’s pretty simple. Lenders will provide you with funds to purchase a car which you’ll have to pay back over a loan term. Your repayments will consist of the principal amount you borrowed plus interest.

Factors that affect car loan interest rates

Car loan interest rates vary from lender to lender, and loan to loan. The following factors are usually examined when determining the interest rate for a loan:

- Age of the vehicle to be purchased (new or used)

- Type of vehicle (sedan, van, ute, luxury, etc)

- Type of loan (secured or unsecured)

- The total amount being borrowed

- The financial status of the applicant

Your perceived ability to pay back the loan may also affect the interest rate on your car loan. Lenders will review your credit score or look at your debt-to-income ratio to see if you can make your repayments. If you’ve got a high credit score and good finances, you have better chances of getting a good interest rate.

Get the best deal on your car loan

When it comes to car loans, don’t be fooled by deceptively low or non-existent interest rates. Car loans that boast a 0% interest rate are not what they’re cracked up to be. Often, these no-interest car loans have a plethora of hidden costs and strict conditions. You may end up paying more compared to a similar loan with low-interest rates.

Always read the fine print when you’re searching for the best car finance. Aside from looking at a car loan’s interest rate percentage, look at other conditions such as:

- The loan term

- The repayment frequency (weekly, fortnightly, or monthly)

- The type of loan product

- The loan structure

- Payout penalties

- Additional fees and charges

To get the best deal on your car loan, you must look at the whole picture. It’s not enough that a car loan has low interest rates. It should also have features and conditions that are beneficial to your financial situation.

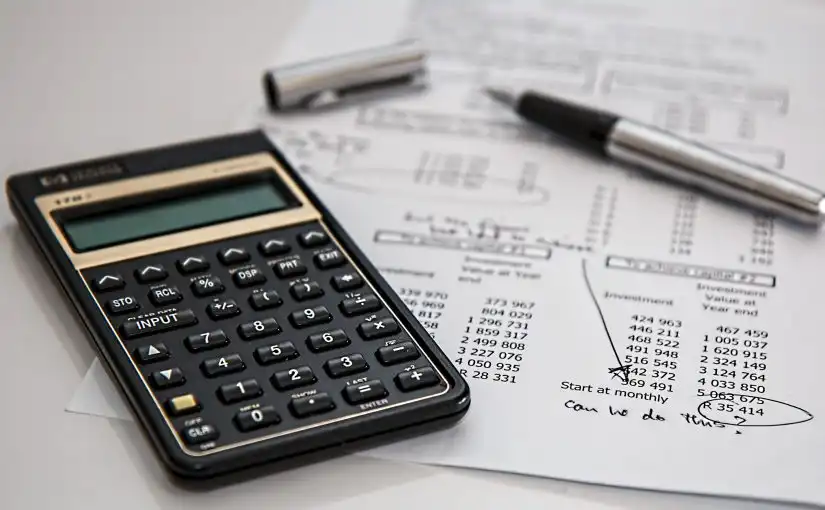

Use a car finance calculator to your advantage

See if a car loan fits your needs by using a car finance calculator. This handy online tool lets you estimate your repayments depending on the information you provide such as the loan amount, payment frequency, and interest rate. The online car loan calculator can provide a ballpark of your repayment and total loan costs.

After you’ve reviewed your loan options, see which one can provide you with the best deal. Input the basic information into the car loan calculator to see a breakdown of your possible repayments and total loan costs.

Don’t apply to multiple lenders— use a broker instead

Applying to multiple lenders can be detrimental to your car loan search and lower your credit score. Multiple finance applications, even for loan pre-approvals, will show on your credit history which may give lenders pause. Having a ‘busy’ credit history could also flag you as a greater risk, which may result in higher interest rates or rejections of your loan application.

If you’re determined to get the best deal on your car loan, it’s best to contact a trusted car finance broker. Aussie Car Loans, powered by CarLoans.com.au, works with countless lenders to help give you the best value car loan. As a brokerage service, we’ll be there from application to settlement.

Save time, money, and effort; get the best car finance with the help of Aussie Car Loans. Call us on 1300 889 669, or simply apply online to get started today.